The IRS has a tool to estimate how much to withhold to keep that money year-round. See 2021 Tax Brackets.

2022 Income Tax Withholding Tables Changes Examples

2022 Income Tax Withholding Instructions This document is designed to provide you with an overview of the Vermont Withholding Tax.

Irs 2022 tax withholding tables. Next up in 5. 2021 Tax Withholding Tables - Federal Revised 1821 Page 1 of 5. From 2020 and beyond the Internal Revenue Service will not release federal withholding tables Publication 15.

By way of reminder IRS says that although the overhauled W-4P will be available in 2022 it wont be required until Jan. Form W-4P withholding In addition to withholding tables Publication 15-T includes the computational bridge employers may need if they expect employees to fill out the 2021 Form W-4P during some or all of 2022. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The IRS update to the Tax Withholding tables for 2022 might result in a change to the net amount to your benefit. These tables will not affect the gross amount. Personal Exemption 0 Personal Exemption one for each qualifying household member.

The Federal income tax withholding tables c hanged effective January 1 2021. The IRS Publication 15-T Federal Income Tax Withholding Methods provides the tables for the. 2022 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities STANDARD Withhol Rate IS NOT WA 2 Checkbox Withholding Rate is 2020 ater in 2 that Ad Adjusted At gaso 9342S S220300 250 S2S 450 _8SO S550700 this with t w d is.

The tables include federal withholding for year. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. The additional standard deduction for those age 65 and over or the blind is 1400 for 2022 or 1750 if the taxpayer is also unmarried and not a surviving spouse.

Refer to your warrant receipt or automatic deposit receipt for LACERA-specific information. The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022. There are seven federal income tax rates in 2022.

To learn more about your tax status please consult with your tax advisor. Reporting income tax withholding and FICA taxes for first quarter 2022 Form 941 if you deposited on time and in full all of the associated taxes due. May 16 Exempt organizations.

This page provides detail of the Federal Tax Tables for 2022 has links to historic Federal Tax Tables which are used within the 2022 Federal Tax Calculator and has supporting links to each set of state. Dont want the government to keep your money for you until you file taxes. The IRS recommends checking withholding at least once a year.

Example video title will go here for this video. The tax withholding estimator on. 2022 Federal Withholding Tax Table Update your payroll tax rates with these useful tables from IRS Publication 15 Circular E Employers Tax Guide.

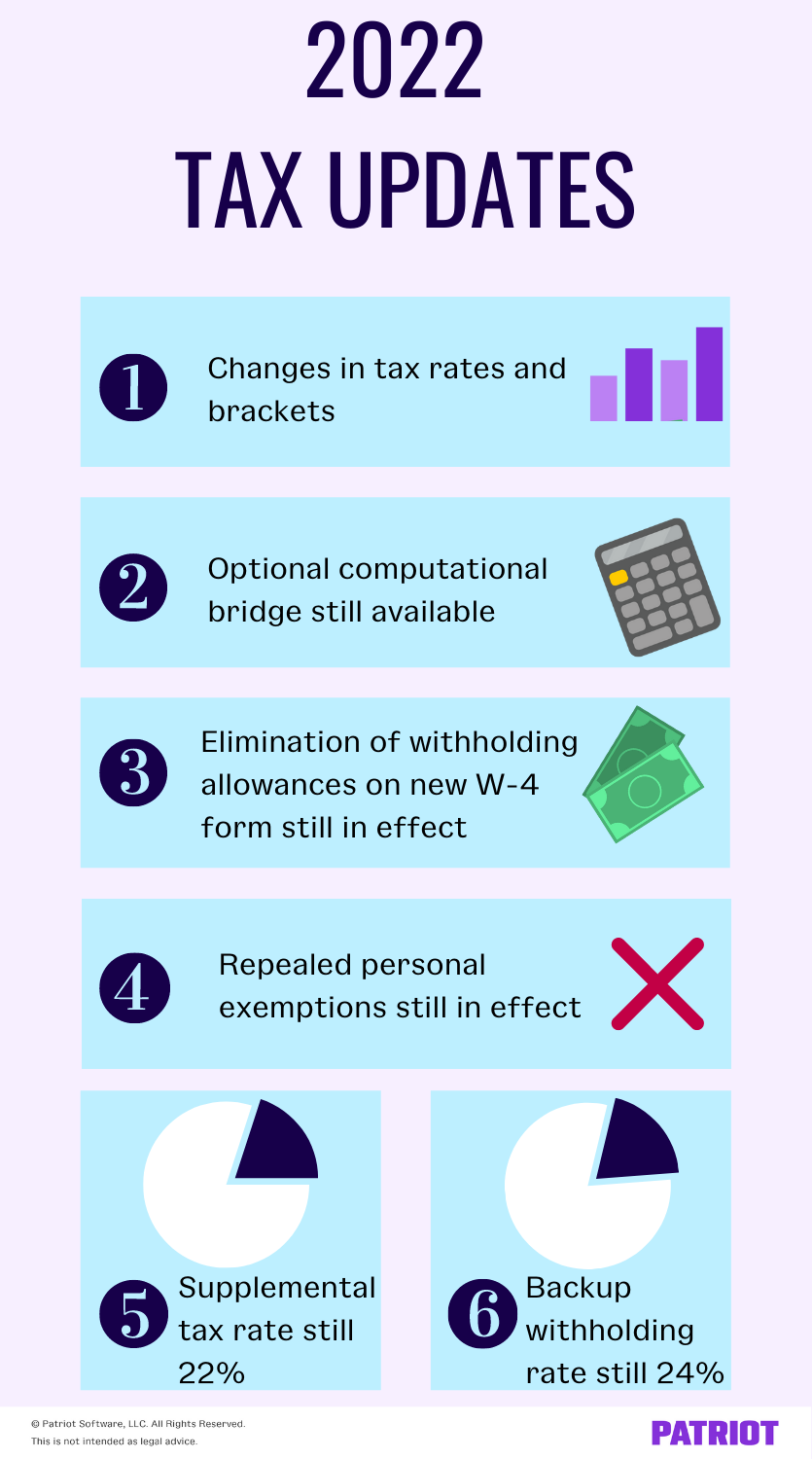

The IRS posted a new warning for taxpayers on April 13 advising them to check their tax withholding once theyre done with this years tax return. Between 2021 and 2022 many of the changes brought about. Federal tax rate deductions credits social security tax rate medicare tax.

The IRS Publication 15 includes the tax withholding tables. According to the tax agency doing this will allow you to make sure youre having the right amount of tax taken out of your pay in 2022. The IRS changes these tax brackets from year to year to account for.

If you need further clarification contact information for the Business Section of the Vermont Department of Taxes is found on page 2 of this document or by visiting our website at taxvermontgov. So 00 so 00 S 027 so S480750. 7 rows 2022 income tax withholding tables.

Individuals who are both aged and blind may receive both standard deductions increases. The Internal Revenue Service released the federal withholding tables to help employers figure out how much tax to withhold from the employers paycheck. 505 PM EDT April 18 2022 Updated.

The employer is liable to pay the deferred taxes to the IRS and must do so before January 1 2022 to avoid interest penalties and additions to tax on The Percentage Method and Wage Bracket Method withholding tables the employer instructions on how to figure employee withholding and the amount. 505 PM EDT April 18 2022. The Internal Revenue Service has an online tool called the Tax Withholding Estimator to help do that.

And even though were already 3 12 months into the 2022 tax year its not too late to start. June 15 2022 2nd installment deadline to pay 2022 estimated taxes due Sep 15 2022 3 rd installment deadline to pay 2022 estimated taxes due Oct 17 2022 Last day to file federal income tax return if 6-month extension was requested by April 18 2022. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Filing a 2021 calendar-year information return Form 990 Form 990-EZ or Form 990-PF or filing for an automatic six-month extension Form 8868 and. 2022 Income Tax Withholding Tables and Instructions for Employers. The charts include federal withholding income tax FICA tax Medicare tax and FUTA taxes.

The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax-rate schedules and tax tables and cost-of-living. The following payroll tax rates tables are from IRS Publication 15 T. PDF 78378 KB - December 10 2021.

Ring in new tax rates for 2022. Federal Income Tax Tables 2022. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year.

The IRS Tax Withholding Estimator can help determine how much or little to withhold from paychecks to get the amount you owe or get back at tax time to zero.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

0 Komentar